Isle of Man Company Formation

The Isle of Man is a small island located in the Irish sea between England and Ireland. It is a dependency of the British Crown and recognises the monarch as Head of State. It is not, however, part of the United Kingdom and never has been, though it is in the British Isles. It has its own parliament (which mirrors the structure of the UK’s parliament), and is not a member of the European Union.

Why is the Isle of Man an Attractive Offshore Centre?

The Isle of Man is an international and commercial financial centre with a stable political climate and competitive taxation.

As an internationally renowned offshore financial centre, this is a highly popular location for company formation. It gives international investors access to an independent jurisdiction that follows the regulations and rules in place in Great Britain. What’s more, it offers a superb investment environment in many industries, including finance, online gaming and insurance.

According to the World Bank, the Isle of Man is one of the richest territories in the world based on its Gross Domestic Product per capita. Many diverse sectors, including aviation, offshore banking, finance and tourism, contribute significantly to the island’s economy.

Further, due to its simple and efficient laws, the island has maintained a successful business and investment environment. It has a robust infrastructure, including power and telecoms, and excellent connectivity.

The finance sector in the Isle of Man is governed by the Financial Supervision Commission, an independent statutory body established in 1983. This body is responsible for the licensing and supervision of banks, building societies, investment businesses, collective investment schemes and companies which provide company and trust administration services. It is also responsible for the Companies Registry.

Finally, the Isle of Man has a low-tax economy, including a zero corporate income tax for many types of activities.

Benefits of an Isle of Man Offshore Company

An Isle of Man offshore company is ideal for a number of activities, and offers numerous advantages. It offers a prosperous business environment, as taxes on profits, annual turnover or capital are nil (unless the company participates in local banking operations or asset transactions operating in the Isle of Man).

One significant benefit of Isle of Man company formation is the location of the island, which is incredibly close to the UK and the rest of Europe. It welcomes international investors, and has a strong business environment.

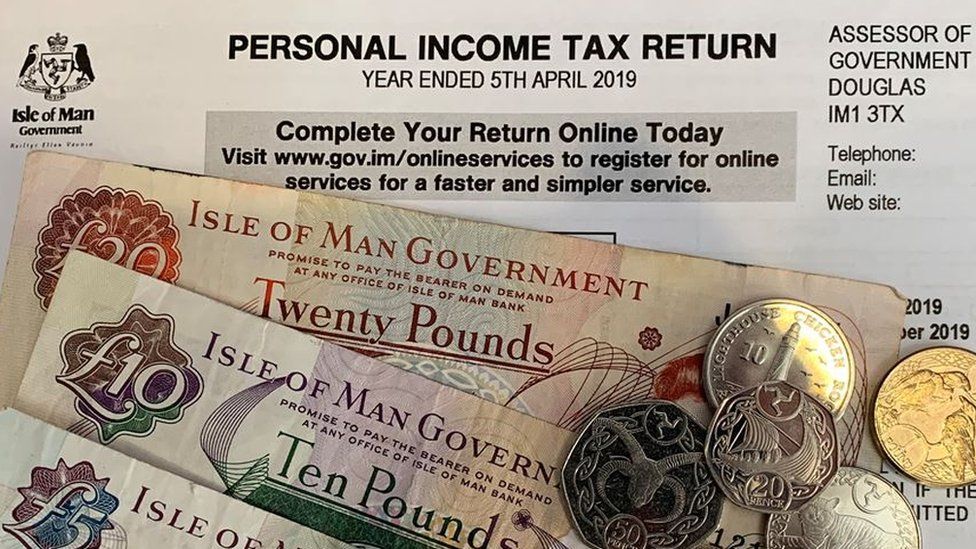

For companies, the Isle of Man operates a zero rate tax regime. There are provisions for preventing the avoidance of tax by residents, through holding assets within companies they own. Certain finance sector companies operating on the island pay tax at a rate of 10%. There is also a double taxation treaty with the United Kingdom. In addition to offering the above advantages, the island also has low personal income tax rates.

This is a flexible environment in which to form a company, and may be formed by one or more shareholders (either individual or legal persons).

Types of Companies Available in the Isle of Man

Companies can be formed in the Isle of Man in one of two ways: The Companies’ Act 1993-2004, and the Companies’ Act 2006.

Investors seeking to set up a company in the Isle of Man can choose between a Limited Liability Company and a Partnership. There are a number of rules in place that provide for trusts and foundations, representing significant tax planning tools there.

One of the most popular company types in the Isle of Man is the offshore company, which is governed by the International Business Act of 1994.

Isle of Man Offshore Company Requirements

In order to open an offshore company in the Isle of Man, a company name must be chosen that ends in Limited/Ltd, or Public Limited Company/PLC. A minimum of one director must be appointed, who can also be a natural or legal individual (and not necessarily a resident). By law, a local physical address on the isle is required, along with a local registered agent who is duly licensed. You will also need an Isle of Man bank account, as well as all necessary documentation needed for incorporation.

Isle of Man Company Formation with Chesterfield

Investors can register their chosen company type with ease with the support and guidance of Chesterfield’s team of specialists. Our team of consultants remains on hand at every step of the incorporation process and beyond, ensuring every detail is attended to.

Contact Chesterfield today to discuss your Isle of Man company formation requirements.